About Limited Liability Company LLC Legal Forms Software

What is the Limited Liability Company LLC Legal Forms software?

Have an LLC question?

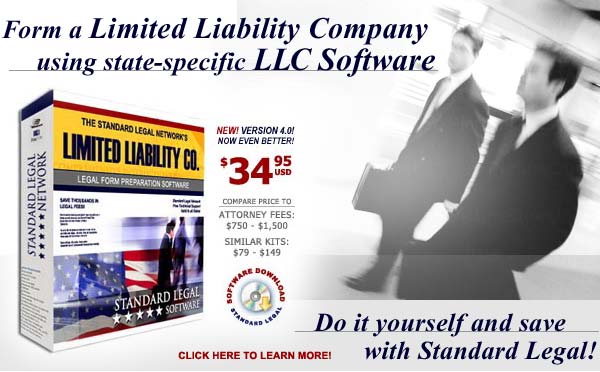

You can create an LLC, or Limited Liability Company, quickly and easily using some simple LLC Software.

In this do-it-yourself LLC software, a detailed list of considerations for creating an LLC are presented first. Then use the most up-to-date state-specific forms available to create a legal and valid Limited Liability Company! Finally, a template for developing the LLC's Operating Agreement finishes the process. Clear instructions and pertinent advice make Standard Legal's LLC Software the perfect solution! Complete details below...

LIMITED LIABILITY COMPANY SOFTWARE :: LLC LEGAL FORMS

Many of today's business professionals will tell you that an LLC (Limited

Liability Company) presents an attractive alternative to corporations

and partnerships because LLCs combine many of the advantages of both. With an LLC, the members can have the corporate-like liability

protection for their personal assets from business debt, while also

enjoying the tax advantages of partnerships or "S" Corporations (i.e.

elimination of dual taxation). The LLC has been compared to an "S"

Corporation without the IRS restrictions. LLC's allow for pass-through

taxation (similar to that of partnerships and S Corporations).

An LLC is a business structure which is recognized by all 50 states and

Washington, D.C. An LLC is a separate legal entity (as is a

corporation). For money, property, expertise or "sweat equity" invested

into the company, the LLC issues certificates or units that indicate

the particular investor's percentage of ownership in the business

(compare to a corporation that issues shares of stock to its shareholders).

Some ADVANTAGES of forming a Limited Liability Company are:

- Provides protection of personal assets from business debts and other obligations;

- Profits/losses pass through to personal income tax returns of the members;

- Provides great flexibility in management and organization of the business;

- LLCs do not have the ownership restrictions of S Corporations, making them ideal business structures for "non-traditional" investors.

DISADVANTAGES of forming a Limited Liability Company are:

- LLCs often have a limited life (not to exceed 30 years in some states)

- LLCs are not corporations and therefore do not have stock, thereby creating some difficulty in both the transfer of ownership of the company and/or the distribution of benefits.

This simple, yet complete, do-it-yourself Legal Software LLC program includes the Articles of Organization

and all of the other state-specific forms and up-to-date instructions

required to create a Limited Liability Company. The program also

includes three different types of Operating Agreements:

- Multi-Member MEMBER-Managed Operating Agreement;

- Multi-Member MANAGER-Managed Operating Agreement;

- Sole Member Operating Agreement

Offering three different Operating Agreements allows the members of the

LLC to clearly define the roles of each investor/member in managing and

operating the business, and how profits will be disbursed. The software

also includes a LLC Unit Certificate template that can be completed and

provided to each member of the LLC, showing the number of "units" (like shares) that are held by that member.

In addition to all required forms and instructions, a detailed examination of a variety of business structures is provided, so that the individuals creating the LLC can make certain that an LLC structure is the best for their business situation.

Tell me more about Limited Liability Company LLC Legal Forms Software!

|